BLOOMINGTON, Ind. – Three professors and a doctoral candidate in operations and decision technologies at Indiana University’s Kelley School of Business have received some of the top honors in their field, as recognized by their peers.

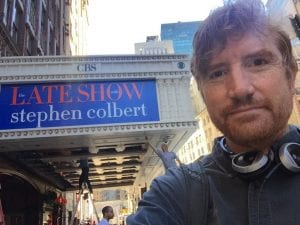

Earlier this month, assistant professor Jonathan Helm (pictured) received the Pierskalla Best Paper Award, which recognizes research excellence in the field of health care management science. This is the highest honor for this area. It was presented at the INFORMS Conference on Operations Research and Management Science.

Earlier this month, assistant professor Jonathan Helm (pictured) received the Pierskalla Best Paper Award, which recognizes research excellence in the field of health care management science. This is the highest honor for this area. It was presented at the INFORMS Conference on Operations Research and Management Science.

Mochen Yang, also an assistant professor, received the Nunamaker-Chen Dissertation Award, which recognizes outstanding dissertation research by scholars in the field of information systems. Doctoral candidate Jane Tan was a runner-up for the same award, presented by the Information Systems Society.

Another Kelley professor, Munirpallam “Venkat” Venkataramanan, will be honored by the Decision Science Institute when it convenes for its annual meeting this weekend.